What Makes Finfront Different

Multi-Expert Financial Analysis

Finfront’s AI simulates multiple financial experts — each offering a specialized perspective.

The result is a 360° financial review that feels like having a full team of financial

advisors working for you.

From Insight to Impact — Automatically

Every insight is linked directly to your financials and assigned as an actionable task.

Finfront tracks execution and quantifies results — no manual tracking, no guesswork.

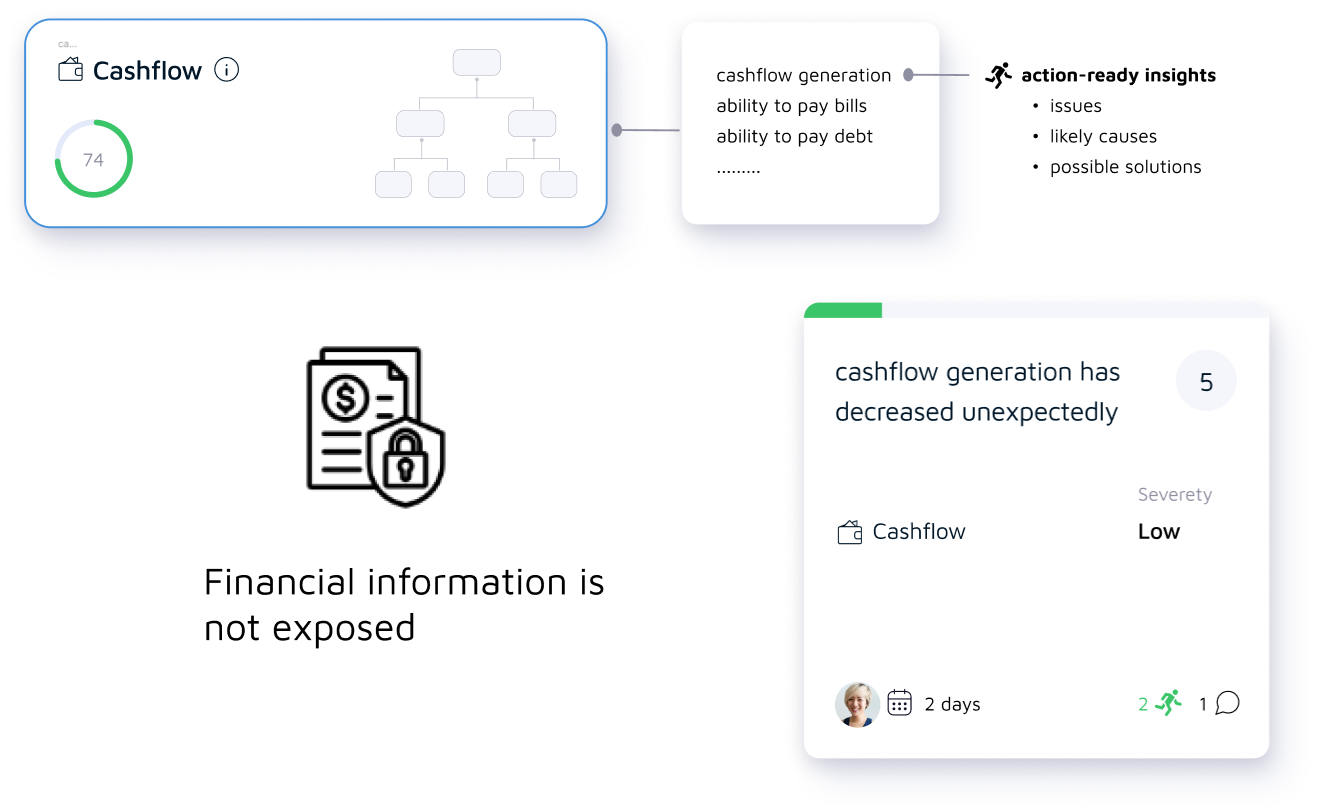

Secure and Private

All insights and assignments are done without exposing your company’s financial data, ensuring

complete privacy and compliance.

Alignment Across Teams

Finfront turns insights into team action. As employees complete assigned insights, they directly contribute

to measurable financial improvements — aligning daily operations with company-wide financial goals.

Finfront is like having an AI-driven financial improvement team working for you 24/7.

Finfront is agentic AI designed for Financial Performance Management (FPM) that uses Business

Intelligence (BI) and Financial Planning & Analysis (FP&A) tools to automate the last mile of FPM.

Finfront doesn’t aim to replace your existing FP&A or BI tools.

FP&A = plan the numbers

Finfront = move the numbers

Data insights alone do not deliver financial improvement.

AI is expected to drive business outcomes from your data. However, AI today gets you as far as "actionable insights". These then have to be manually processed and tracked to obtain any benefits. Finfront is the only software that automates the process of going from insights to financial improvement. These last crucial steps or last mile of financial performance management are what drives business outcomes.

Visibility over financial health

Finfront conducts a comprehensive multi-view analysis of your

company's financial health. Each view is created from the perspective of different financial

experts.

These AI experts examine aspects such as cashflow, profit, capital structure, liquidity among many others.

Finfront will score, rate, set targets and create action-ready insights for each of these aspects.

Read more in this article.

Action-ready insights

Finfront creates action-ready insights when it detects possibilities for improvement.

Each insight is assigned an owner and actions for improvement. They are then tracked to

resolution.

Furthermore, each insight is linked back to your financials so you can see the

impact. Financial privacy is protected because these insights do not expose financial information.

Action-ready is much more than actionable, read more in this article.

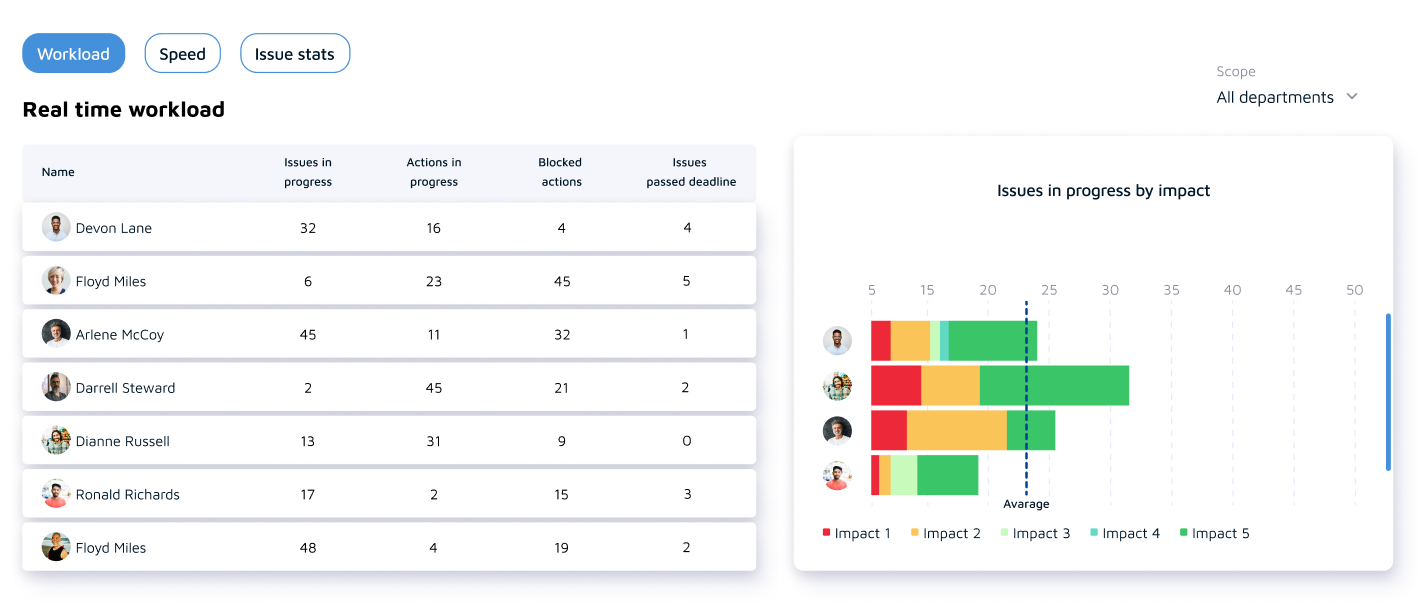

Align your team with your financial

performance

Finfront engages your team into action as they resolve the action-ready insights.

As your team executes the industry best practices included in these insights, they align their activities

with your financial performance.

No financial information is shared with your team.

It is all automated

Finfront will automatically monitor performance and track your progress. You will get alerts if things get off track. You get real time visibility over your team’s workload, contribution and performance.

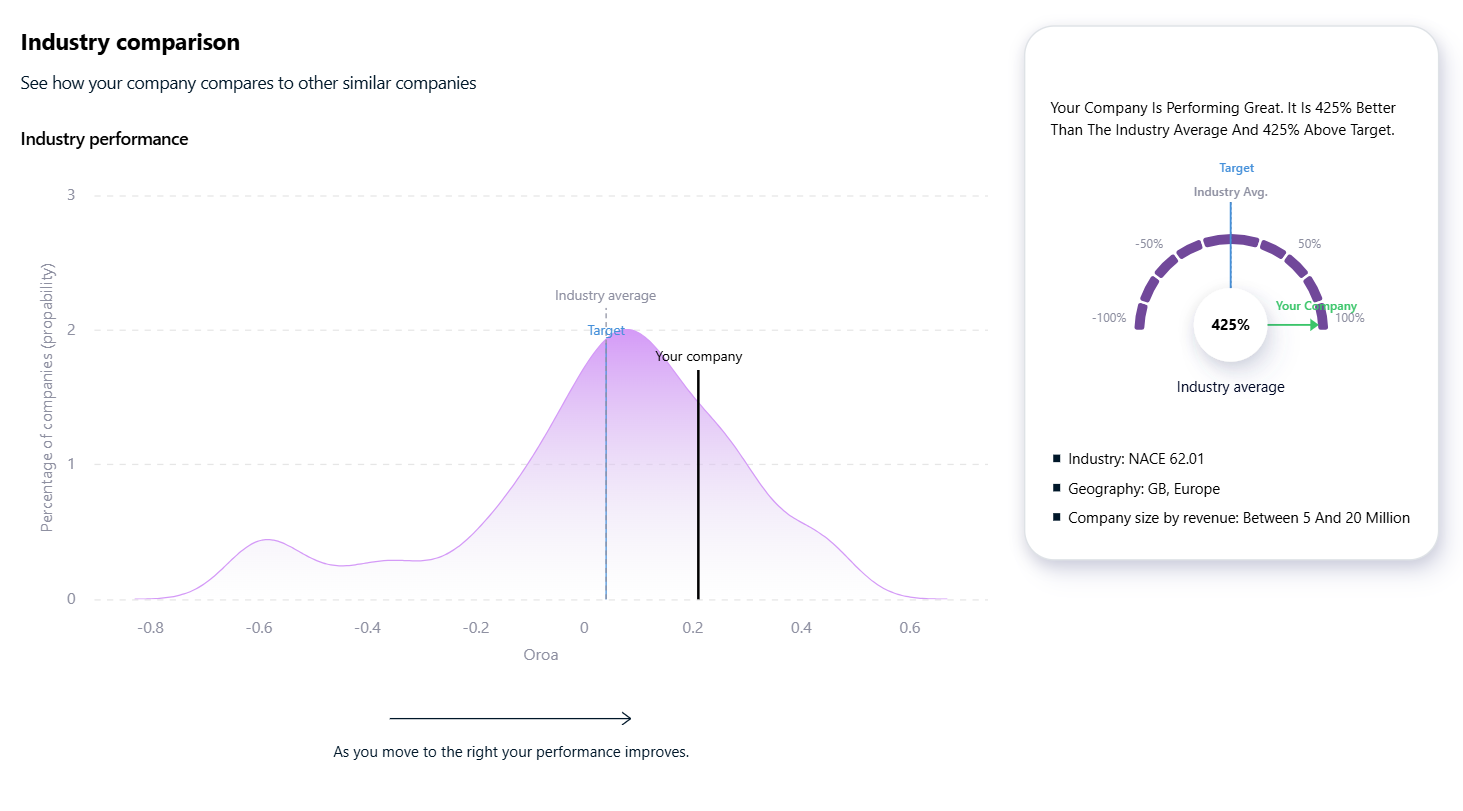

Compare yourself to companies like yours

You can see how you measure up to others for each aspect of financial

health.

Finfront has comprehensive industry benchmarks tailored to your industry, geography and company size.

From financial data to business outcomes

Finfront is designed for the last mile of financial performance management. The final, crucial phase where finance transforms numbers into insights and insights into tangible business outcomes (read more).

Understand your performance

without having to log in

to

multiple systems

Finfront analyses your

company's performance by connecting to your

accounting and business software.

Happy and engaged team

Achievable objectives: Our AI estimates

your team’s capabilities and creates milestones they can actually achieve. This has proven to help keep teams

enganged.

Credit where credit is due: Enable your team to acknowledge and celebrate individuals for their

contributions.

know why? Each team member can see why taking action makes a difference, and how others are

contributing. Teams are most efficient when they can see the impact of their contributions.